Tax proposals affecting private companies and their shareholders: income splitting

This is the third in a series of posts arising out of the Liberal Government’s paper “Tax Planning Using Private Corporations.” In the first post ... Continued

Our expertise helps our clients understand how the law affects their business

This is the third in a series of posts arising out of the Liberal Government’s paper “Tax Planning Using Private Corporations.” In the first post ... Continued

Emily Clough, a partner in our Estates & Trusts group, was successful counsel for the plaintiff in a complex and precedent-setting case released yesterday by ... Continued

This is the second in a series of posts arising out of the Liberal Government’s paper “Tax Planning Using Private Corporations.” The Income Tax Act ... Continued

A “committee” is a legal guardian, appointed by the court, to act for an individual who has reduced capacity. A “committee of estate” acts for ... Continued

The Supreme Court of Canada has confirmed that, when assets are transferred from a parent to an adult child without anything given in return, the ... Continued

This is the first in a series of posts arising out of the Liberal Government’s paper “Tax Planning Using Private Corporations”. The Liberal Government announced ... Continued

Earn-outs are very common these days in transactions where an owner is selling a business. I’m working on a number of transactions right now that ... Continued

“The cost of large-scale hydro and run-of-river hydro haven’t gone down, whereas the cost of wind and solar power continue to fall,” explains David Austin ... Continued

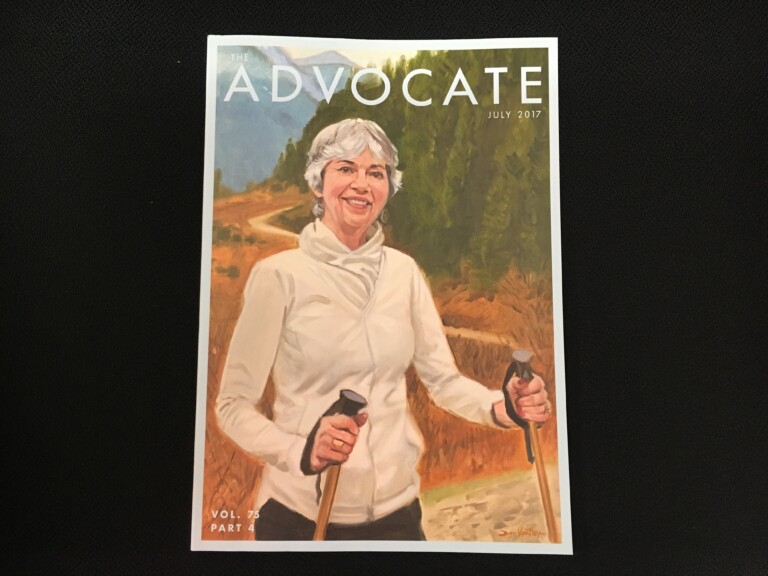

Who hikes faster than a speeding bullet and leaps mountains in a single bound? The Honourable Marion J. Allan, of course… And so begins the ... Continued

Lauren Liang’s recent article on inheritance rights of children born out of wedlock was republished by Quickscribe Reporter in its June edition. Quickscribe Reporter is ... Continued

Legislative amendments launched last year to allow strata corporations to sell their entire building and land with 80% owner approval, which has created a wave ... Continued

One term that you may hear when negotiating the sale of your business – or the purchase of a new business – is “conditions precedent” ... Continued